what happens if a repo car is never picked up

What Happens When Your Car is Repossessed - And Your Options

1. What does it mean when a car is repossessed?

When a car is repossessed, it means that the lender or financial institution has taken possession of the vehicle due to the borrower's failure to make timely loan payments. Repossession generally occurs when a borrower is significantly behind on their loan payments and has not made arrangements with the lender to catch up on the missed payments.

- A car repossession can occur due to various reasons, such as defaulting on the loan, non-payment of insurance, or violating the terms of the loan agreement.

- Repossession is typically the last resort for the lender, as they would prefer the borrower to fulfill their financial obligations.

- Once a car is repossessed, the lender has the right to sell the vehicle to recover the remaining loan balance.

2. What are the consequences of car repossession?

Car repossession can have several consequences for the borrower:

- Negative impact on credit score: Car repossession is reported to credit bureaus and can significantly lower the borrower's credit score, making it difficult to obtain future loans or credit.

- Potential legal action: If the sale of the repossessed vehicle does not cover the remaining loan balance, the lender may pursue legal action to recover the outstanding debt.

- Loss of transportation: Losing a car to repossession can leave the borrower without reliable transportation, which can greatly inconvenience them in their daily life.

3. How can I avoid car repossession?

To avoid car repossession, there are several steps you can take:

- Communicate with the lender: If you anticipate falling behind on your loan payments, it's essential to communicate with your lender or financial institution. They may be willing to work out a temporary payment arrangement or modify the loan terms.

- Seek financial assistance or counseling: If you're facing financial difficulties, consider reaching out to a financial counselor who can provide guidance on budgeting, debt management, or potential assistance programs.

- Consider refinancing or loan modification: If your current loan terms are unmanageable, explore options for refinancing or loan modification with the help of a financial professional.

- Explore selling the car: If you foresee long-term financial struggles, it may be worth considering selling the car voluntarily to pay off the loan and avoid repossession.

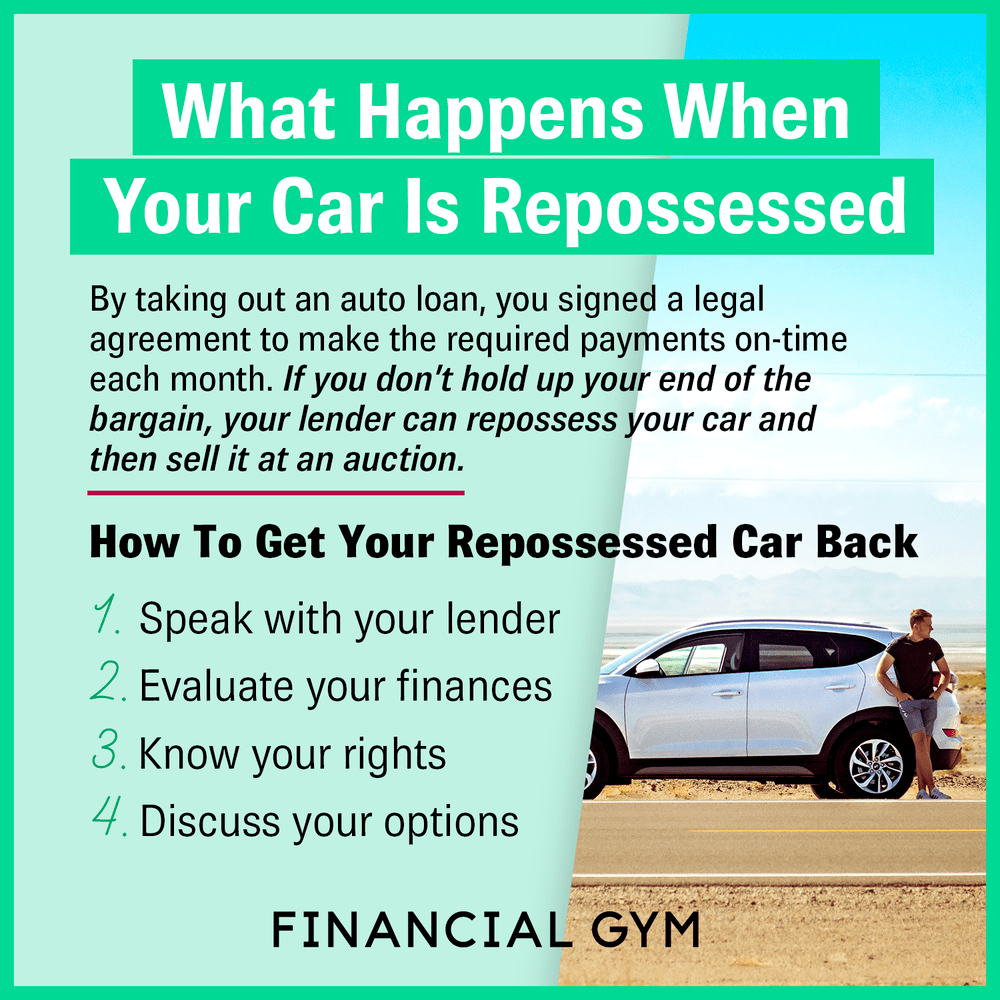

4. Can I get my repossessed car back?

In some cases, it is possible to get your repossessed car back, but it depends on various factors:

- Lender's policies: Some lenders may have policies in place that allow borrowers to reclaim their repossessed vehicles by paying off the outstanding loan balance, plus any associated fees.

- Timeframe: The ability to retrieve a repossessed car is time-sensitive. The sooner you act, the better your chances of getting it back.

- Legal procedures: Depending on your jurisdiction, there may be specific legal procedures or requirements to follow to regain possession of your car.

5. Can I negotiate with the lender after car repossession?

It is possible to negotiate with the lender after car repossession, but success may vary:

- Open communication: Contact the lender and express your willingness and commitment to resolve the issue. Promptly respond to any communication from the lender and provide any requested documentation.

- Negotiate repayment options: Discuss potential repayment or settlement options with the lender. They may be open to negotiating a payment plan or reducing the outstanding debt.

- Consider professional assistance: If negotiations become challenging, it may be helpful to seek assistance from a credit counseling agency or legal professional who specializes in debt resolution.

6. How does car repossession affect my credit score?

Car repossession can have a significant negative impact on your credit score:

- Credit score decrease: A car repossession is considered a severe delinquency and will result in a substantial decrease in your credit score.

- Long-term credit damage: The repossession will stay on your credit report for several years, making it difficult to obtain favorable credit terms in the future.

- Limited borrowing options: Lenders may be hesitant to approve future loans or credit applications due to the repossession history.

7. Will my car be sold immediately after repossession?

After repossession, the lender may choose to sell the car to recover the remaining loan balance, but it may not happen immediately:

- Auction process: Lenders typically sell repossessed vehicles through auctions, which may take some time to prepare and schedule.

- Notice of sale: The borrower should receive a notice of sale, providing them with an opportunity to pay off the outstanding debt and retrieve the vehicle before it is sold.

- Legal requirements: Depending on the jurisdiction, there may be specific legal requirements that the lender must follow before selling the repossessed car.

8. How does car repossession affect my insurance?

Car repossession can have implications for your insurance:

- Loss of coverage: If your car insurance policy was bundled with your auto loan, repossession may result in the termination of your insurance coverage.

- New insurance requirements: If you manage to retrieve the repossessed car or purchase a new vehicle, you will need to secure new insurance coverage to comply with legal requirements.

- Potential premium increase: If your car was repossessed due to non-payment or financial difficulties, it may result in higher insurance premiums in the future.

9. What legal rights do I have during car repossession?

During car repossession, you have certain legal rights that lenders must adhere to:

- No breach of peace: Lenders cannot use force or violate your rights while repossessing the car. They must follow legal procedures and cannot engage in threatening or harassing behavior.

- Right to notification: You have the right to receive notice before the repossession occurs. The notice should include information about the outstanding debt and potential options for resolving the issue.

- Opportunity to retrieve personal belongings: You should have the opportunity to collect your personal belongings from the repossessed vehicle, as long as it does not interfere with the repossession process.

10. Can filing for bankruptcy prevent car repossession?

Filing for bankruptcy can potentially prevent car repossession, but it depends on the specific circumstances and the type of bankruptcy filed:

- Automatic stay: When you file for bankruptcy, an automatic stay goes into effect, which prohibits creditors from taking collection actions, including car repossession.

- Chapter 7 bankruptcy: In Chapter 7 bankruptcy, you may be able to discharge your remaining debt, including the loan associated with the repossessed car.

- Chapter 13 bankruptcy: With Chapter 13 bankruptcy, you can create a repayment plan that allows you to catch up on missed car payments and potentially retain possession of the vehicle.

11. Can a cosigner's car be repossessed?

Yes, a cosigner's car can be repossessed if the primary borrower fails to make timely loan payments:

- Cosigner's responsibility: The cosigner is equally responsible for the loan and any missed payments. If the primary borrower defaults, the cosigner can be held liable, and the car may be repossessed.

- Cosigner's credit impact: Just like the primary borrower, a car repossession will negatively impact the cosigner's credit score and financial standing.

- Options for the cosigner: If the cosigner wants to avoid repossession, they can consider taking over the loan payments or working out alternative arrangements with the lender.

12. Can a repossessed car affect my ability to get another loan or lease?

Yes, a repossessed car can affect your ability to get another loan or lease:

- Negative impact on credit history: The repossession will appear on your credit report, indicating a history of loan default and making lenders hesitant to approve future loans or leases.

- Increased interest rates: If you manage to secure another loan or lease, the repossession history may result in higher interest rates, as you would be perceived as a higher credit risk.

- Limited financing options: Some lenders or leasing companies may outright deny your application if you have a recent repossession on your record.

In conclusion, car repossession can have severe consequences for borrowers, including credit score damage, potential legal action, and loss of transportation. However, by communicating with the lender, seeking financial assistance, and exploring alternatives, borrowers can potentially avoid repossession or mitigate its effects. It is important to understand your legal rights during the repossession process and consider professional advice to navigate this challenging situation.